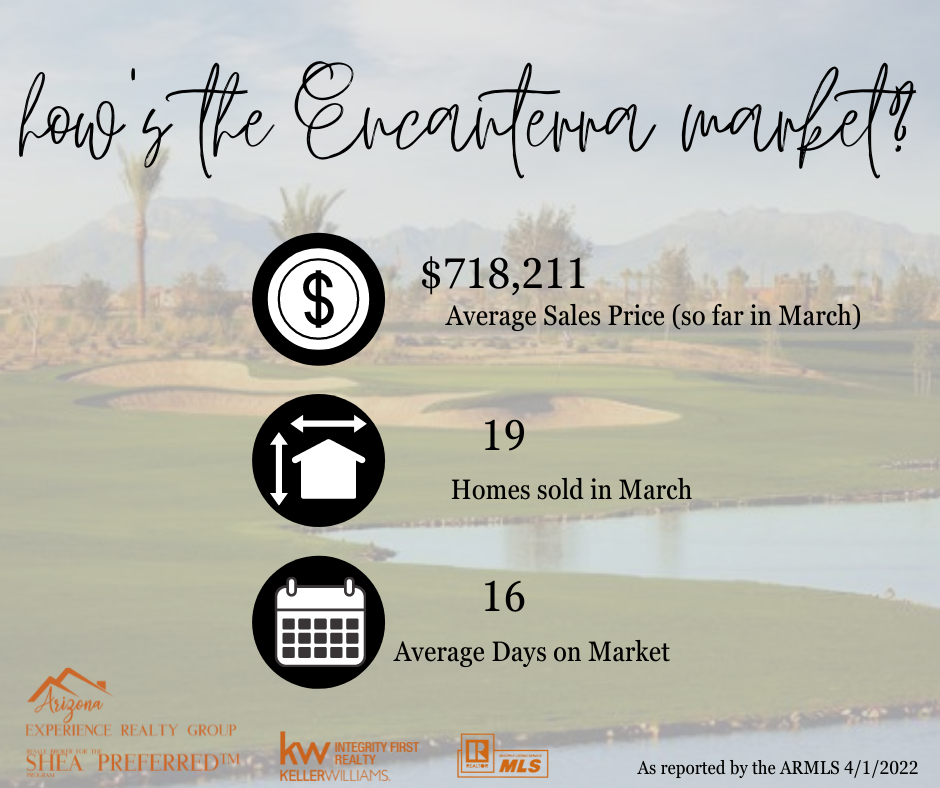

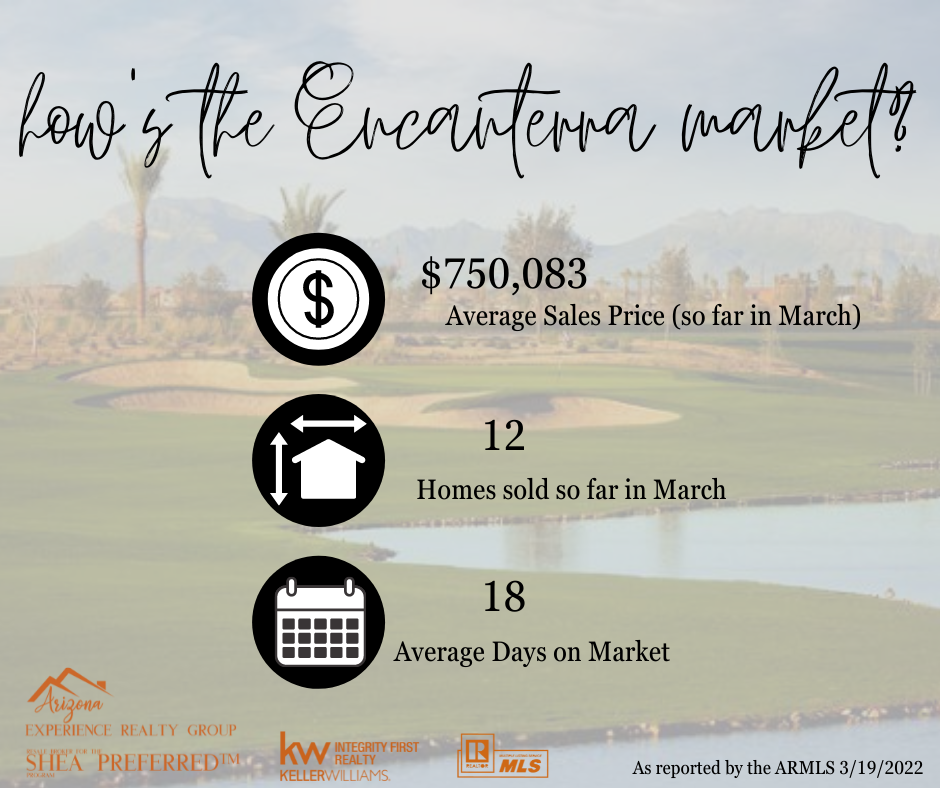

Encanterra Market Report March 2022

As reported by the ARMLS 4/1/2022

Current active listings: 9

Current under contract listings: 21

Current coming soon listings: 1

Still have questions? Or want to know your home’s value? Contact us today! We would be happy to discuss this or any other questions with you.