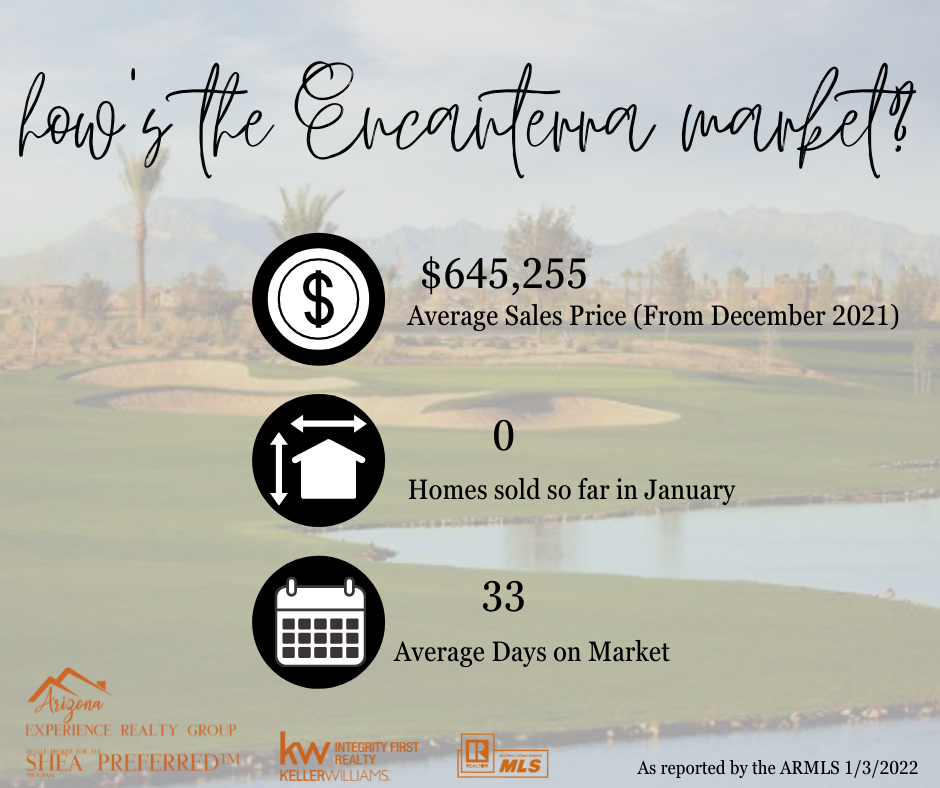

Here are the January Real Estate Market statistics. All data comes from the Arizona Multiple Listing Service. Give us a call for your detailed market analysis or with any questions.

Here are the January Real Estate Market statistics. All data comes from the Arizona Multiple Listing Service. Give us a call for your detailed market analysis or with any questions.

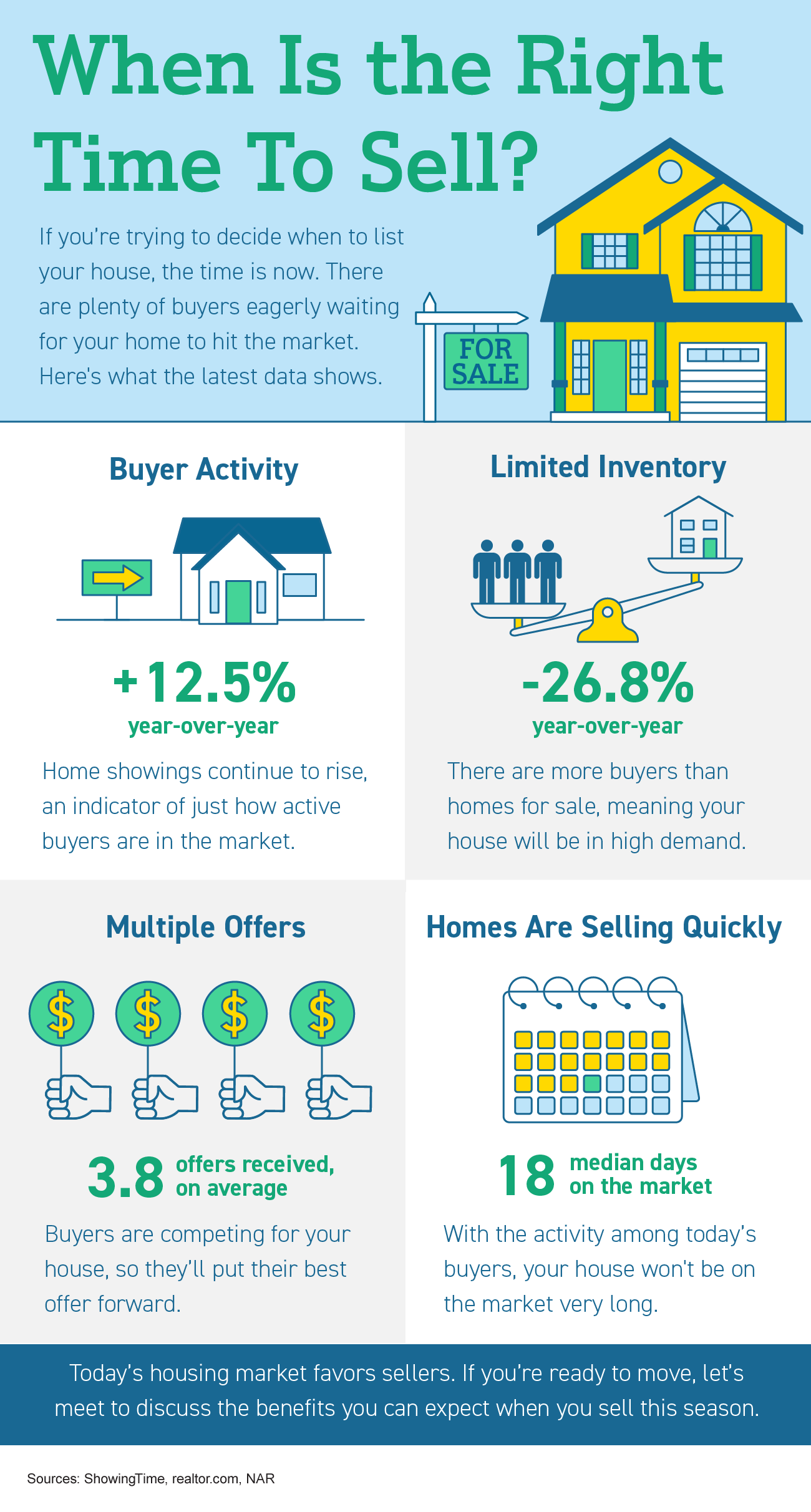

Over the past two years, we’ve lived through one of the most stressful periods in recent history. Because of the health crisis, many of us have spent more time at home and that’s led us to re-evaluate both what we need in a house and how much we appreciate having a safe space. If you’ve found your current home isn’t filling all your needs, you may be wondering if it’s time to find a new one.

There’s reason to believe a change of scenery could boost your happiness. Catherine Hartley, an Assistant Professor at New York University’s Department of Psychology and co-author of a study on how new experiences impact happiness, says:

“Our results suggest that people feel happier when they have more variety in their daily routines—when they go to novel places and have a wider array of experiences.â€

A move could be exactly the new experience you’ve been looking for. If that’s something you’re considering to better your lifestyle, here are a few things to keep in mind.

Buying and selling a home is a major life change, and it’s not a decision you should enter lightly. But, if you’re questioning whether or not a move would bring you more happiness, it’s important to explore if it’s the right choice for you.

To find out more and discuss your options, reach out to a local real estate professional. They’ll explain the process – including how to list your existing house and search for a new one – in clear and simple terms.

You should also think about your lifestyle and what you’re hoping to get out of your move. What needs aren’t being met in your current home? What features would bring you more joy and make your life easier? For example, are you now working remotely and need a home office? Do you crave more fresh air and open outdoor space to unwind in? Knowing the answers to these questions can help you get started and position your real estate advisor to work with you so you can find just the right home.

Home features aren’t the only thing to consider. You should also weigh your options when it comes to location. Is the weather something that’s important to you? Does it have a tendency to impact your mood? If it does, you may want to factor it into your next move. The World Population Review shares:

“What states have the best weather? When evaluating each state for temperature, rain, and sun, some states stand out. . . . Climate and weather preferences are personal and subjective. . . . “

Better weather can mean different things to different people. Some prefer the heat, others cooler temperatures, and some want to experience all four seasons. Think about what makes you feel happiest and prioritize that in your home search. If you’re moving to a whole new location, your agent is a great resource with a strong network to support you along the way.

Moving could provide you with a fresh beginning and the chance to find happiness in your new home. Let’s connect today to talk about your goals and options in the current market.

Mortgage rates have increased significantly since the beginning of the year. Each Thursday, Freddie Mac releases its Primary Mortgage Market Survey. According to the latest survey, the average 30-year fixed-rate mortgage has risen from 3.22% at the start of the year to 3.55% as of last week. This is important to note because any increase in mortgage rates changes what a purchaser can afford. To give you an idea of how rising mortgage rates impact your purchasing power, see the table below:

While it’s always difficult to know exactly where mortgage rates will go, a great indicator of where they may head is by looking at the 50-year history of the 10-year treasury yield, and then following its path. Understanding the mechanics of the treasury yield isn’t as important as knowing that there’s a correlation between how it moves and how mortgage rates follow. Here’s a graph showing that relationship over the last 50 years:

This correlation has continued into the new year. The treasury yield has started to climb, and that’s driven rates up. As of last Thursday, the treasury yield was 1.81%. That’s 1.74% below the mortgage rate reported the same day (3.55%) and is very close to the average spread we see between the two numbers (average spread is 1.7).

With this information in mind, a 10-year treasury-yield forecast would be a good indicator of where mortgage rates may be headed. The Wall Street Journal just surveyed a panel of over 75 academic, business, and financial economists asking them to forecast the treasury yield over the next few years. The consensus was that experts project the treasury yield will climb to 2.84% by the end of 2024. Based on the 50-year history of following this yield, that would likely put mortgage rates at about 4.5% in three years.

While the correlation between the 30-year fixed mortgage rate and the 10-year treasury yield is clear in the data shown above for the past 50 years, it shouldn’t be used as an exact indicator. They’re both hard to forecast, especially in this unprecedented economic time driven by a global pandemic. Yet understanding the relationship can help you get an idea of where rates may be going. It appears, based on the information we have now, that mortgage rates will continue to rise over the next few years. If that’s the case, your best bet may be to purchase a home sooner rather than later, if you’re able.

Forecasting mortgage rates is very difficult. As Mark Fleming, Chief Economist at First American, once said:

“You know, the fallacy of economic forecasting is don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.â€

However, if you’re either a first-time homebuyer or a current homeowner thinking of moving into a home that better fits your changing needs, understanding what’s happening with the 10-year treasury yield and mortgage rates can help you make an informed decision on the timing of your purchase.

A full market report will come in the next newsletter!

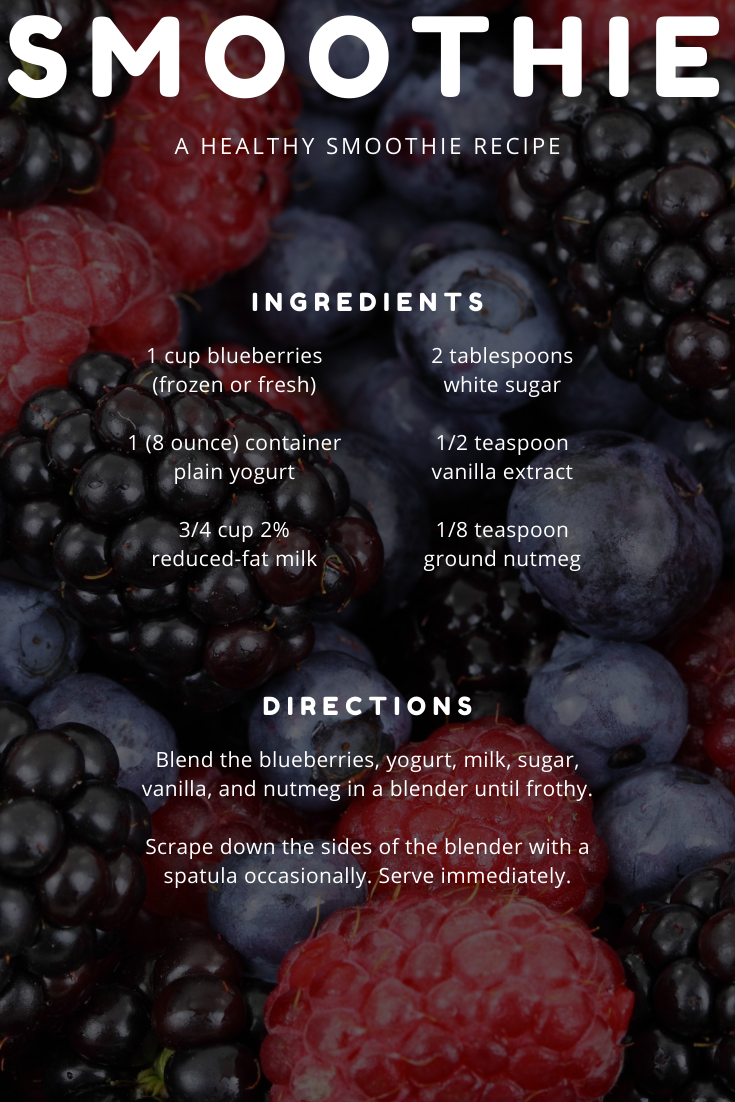

Looking for a healthy option for meal time? Check out this recipe for a healthy smoothie!

Let us know if you tried it, or if you have a favorite go to recipe that you would like to share!

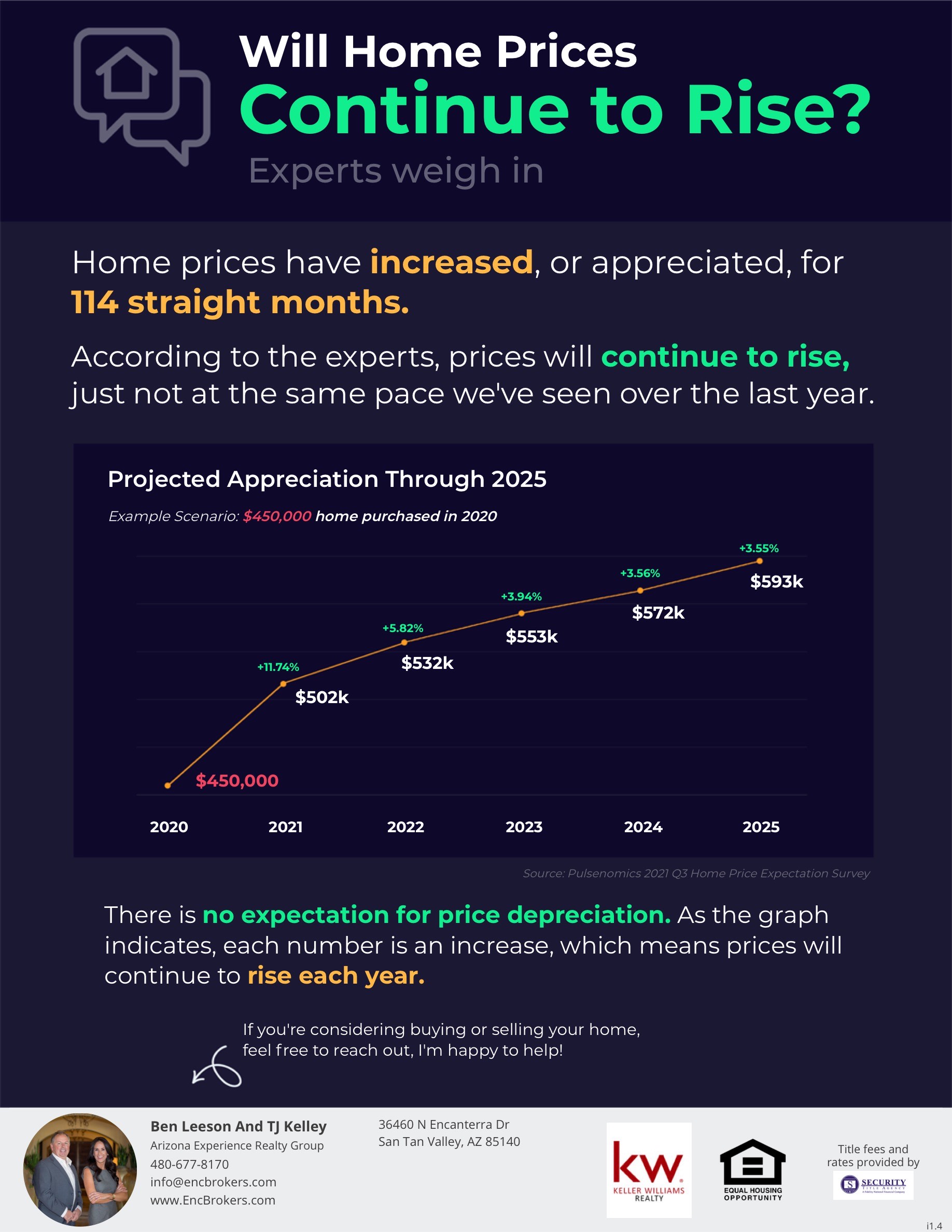

Homes appreciated A TON this past year, and according to experts, there’s more to come! If you have been considering homeownership there is still opportunity for you to build wealth with equity in the coming years. Contact me to get expert help with taking advantage of these historically low rates and starting the journey to homeownership!

Ben Leeson and TJ Kelley

Arizona Experience Realty Group Resale Broker for the SHEA Preferred Program

480-677-8170

Info@ENCBrokers.com

36460 N Encanterra Drive Queen Creek, AZ 85140