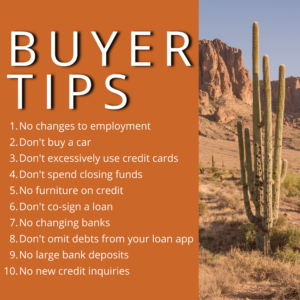

Save this if you’ve started the home search or are considering a move in the future. If you will be obtaining a mortgage – you’ll need it! It’s important to follow these rules as not doing so could have serious financial implications for both you and your future home.

- No changes to employment: Stability is key when it comes to securing a mortgage. Avoid changing jobs or making significant changes to your employment situation during the homebuying process.

- Don’t buy a car: Taking on new debt, such as financing a car, can negatively impact your debt-to-income ratio and affect your mortgage eligibility. Hold off on major purchases until after you’ve closed on your home.

- Don’t excessively use credit cards: High credit card balances can increase your debt load and affect your credit score. It’s best to keep your credit card usage low and make timely payments.

- Don’t spend closing funds: As you approach the closing date, it’s crucial to avoid spending the funds you have set aside for closing costs. Keep those funds accessible and ready for the closing process.

- No furniture on credit: While it may be tempting to furnish your new home before closing, avoid making large furniture purchases on credit. Wait until the mortgage is finalized to avoid any potential issues.

- Don’t co-sign a loan: Co-signing a loan for someone else can increase your debt obligations and impact your ability to qualify for a mortgage. Refrain from co-signing any loans during the homebuying process.

- No changing banks: Maintaining consistent banking history helps streamline the mortgage application process. Avoid changing banks or opening new accounts during this time.

- Don’t omit debts from your loan application: It’s essential to be transparent about your financial situation when applying for a mortgage. Omitting debts or liabilities can lead to complications and potential loan denial.

- No large bank deposits: Unexplained large deposits in your bank account can raise red flags during the mortgage underwriting process. Be prepared to provide documentation for any significant deposits.

- No new credit inquiries: Multiple credit inquiries can negatively impact your credit score. Avoid applying for new credit cards or loans while going through the homebuying process.

Remember, following these guidelines will help ensure a smoother homebuying experience and increase your chances of securing the home you desire. Our team is ready to assist you every step of the way, providing expert advice and answering any questions you may have. Connect with us today to make your homeownership dreams a reality!

Note: When it comes to financial matters and mortgages, it’s always recommended to consult with a professional for personalized guidance.