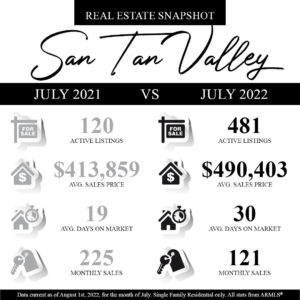

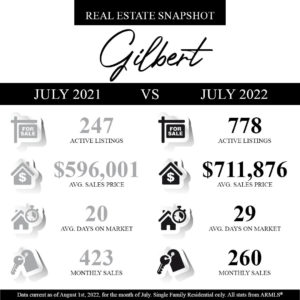

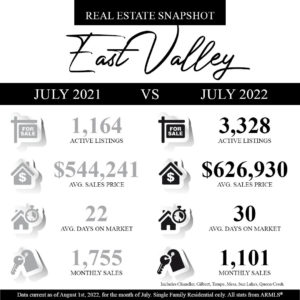

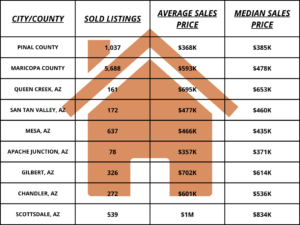

This is what the Arizona real estate market looked like in July 2022 compared to July 2021…broken down into major cities!

Arizona Local Market Snapshot – July 2022

How’s The Encanterra Market For July 2022?

Encanterra Market Report July 2022

As reported by the ARMLS 7/7/2022

Current active listings: 27

Current under contract listings: 2

Current coming soon listings: 1

Still have questions? Or want to know your home’s value? Contact us today! We would be happy to discuss this or any other questions with you.

Why the Growing Number of Homes for Sale Is Good for Your Move Up

Are you thinking about selling your current home? If so, the biggest question on your mind may be: if I sell now, where will I go? If this resonates with you, there’s something you should know. The number of homes coming onto the market is increasing and that could make it easier for you to move up this summer.

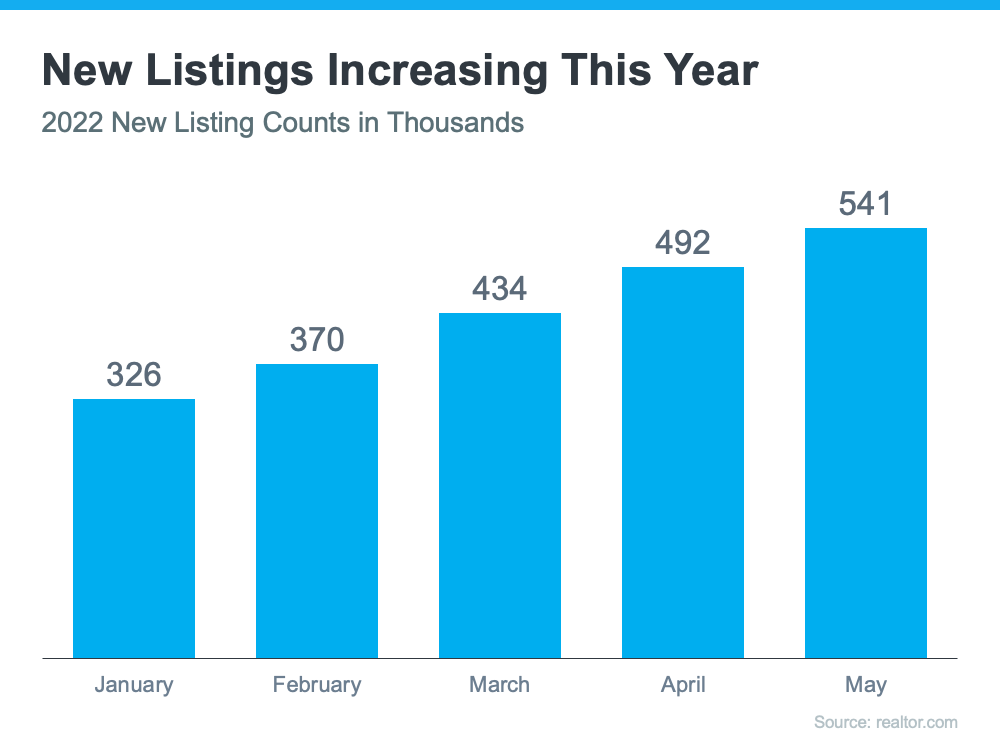

According to the latest data from realtor.com, the number of homes being listed for sale, known as new listings, has increased consistently this year (see graph below):

While this news has clear benefits for buyers who are craving more options for their home search, what does that mean for current homeowners like you? It gives you two distinct opportunities in today’s housing market.

Opportunity #1: Take Advantage of More Options for Your Move Up

If your current house no longer meets your needs or lacks the space and features you want, this gives you even more opportunity to sell and move up into the home of your dreams. As more options come to market, you’ll have more to choose from when you search for your next home.

Partnering with a local real estate professional can help make sure you see these listings as soon as they come onto the market. And when you do find the one, that professional can advise you on how to write a winning offer to seal the deal.

Opportunity #2: Sell Before You Have More Competition

Just know that, in order to make sure your house shines above the rest, it may make sense to put your home up for sale before your neighbors do the same, creating more competition in your area. The increase in the number of homes being listed for sale is expected to continue, and a recent study from realtor.com says two-thirds of homeowners looking to sell say they’ll do so by August.

A real estate professional can advise you on what you need to tackle to get your house ready to list so they can put that for sale sign up in your yard sooner rather than later. That’s because the process of getting a home ready to sell isn’t taking as long as you may think. As a result, you can capitalize on today’s sellers’ market and get ahead of the competition.

Bottom Line

If you’re a current homeowner looking to sell, let’s connect to begin the process. You have a unique opportunity to benefit from the additional homes being listed today and sell before your house has more competition.

Information Source: Keeping Current Matters

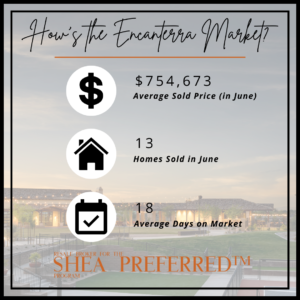

How’s the Encanterra Market for June 2022?

Encanterra Market Report May 2022

As reported by the ARMLS 6/8/2022

Current active listings: 16

Current under contract listings: 12

Current coming soon listings: 3

Still have questions? Or want to know your home’s value? Contact us today! We would be happy to discuss this or any other questions with you.

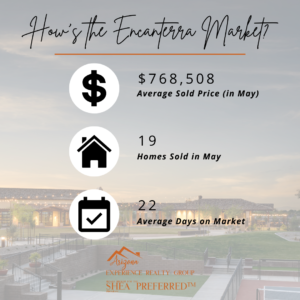

May 2022 | Encanterra Market Report

April 2022 | Encanterra Market Report

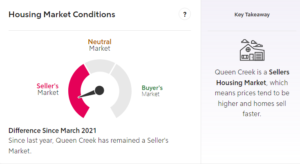

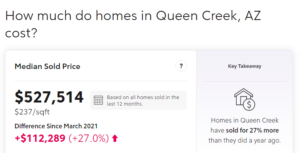

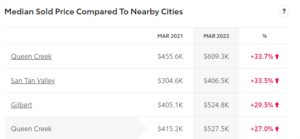

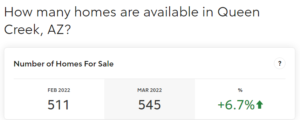

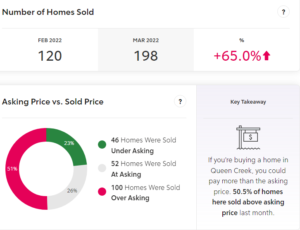

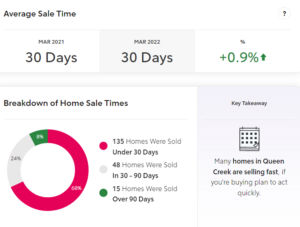

Is Queen Creek, AZ a Buyer or Seller’s Market?

Where Are Mortgage Rates Headed?

There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American:

“You know, the fallacy of economic forecasting is: Don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.â€

Coming into this year, most experts projected mortgage rates would gradually increase and end 2022 in the high three-percent range. It’s only April, and rates have already blown past those numbers. Freddie Mac announced last week that the 30-year fixed-rate mortgage is already at 4.72%.

Danielle Hale, Chief Economist at realtor.com, tweeted on March 31:

“Continuing on the recent trajectory, would have mortgage rates hitting 5% within a matter of weeks. . . .â€

Just five days later, on April 5, the Mortgage News Daily quoted a rate of 5.02%.

No one knows how swiftly mortgage rates will rise moving forward. However, at least to this point, they haven’t significantly impacted purchaser demand. Ali Wolf, Chief Economist at Zonda, explains:

“Mortgage rates jumped much quicker and much higher than even the most aggressive forecasts called for at the end of last year, and yet housing demand appears to be holding steady.â€

Through February, home prices, the number of showings, and the number of homes receiving multiple offers all saw a substantial increase. However, much of the spike in mortgage rates occurred in March. We will not know the true impact of the increase in mortgage rates until the March housing numbers become available in early May.

Rick Sharga, EVP of Market Intelligence at ATTOM Data, recently put rising rates into context:

“Historically low mortgage rates and higher wages helped offset rising home prices over the past few years, but as home prices continue to soar and interest rates approach five percent on a 30-year fixed rate loan, more consumers are going to struggle to find a property they can comfortably afford.â€

While no one knows exactly where rates are headed, experts do think they’ll continue to rise in the months ahead. In the meantime, if you’re looking to buy a home, know that rising rates do have an impact. As rates rise, it’ll cost you more when you purchase a house. If you’re ready to buy, it may make sense to do so sooner rather than later.

Bottom Line

Mark Fleming got it right. Forecasting mortgage rates is an impossible task. However, it’s probably safe to assume the days of attaining a 3% mortgage rate are over. The question is whether that will soon be true for 4% rates as well.

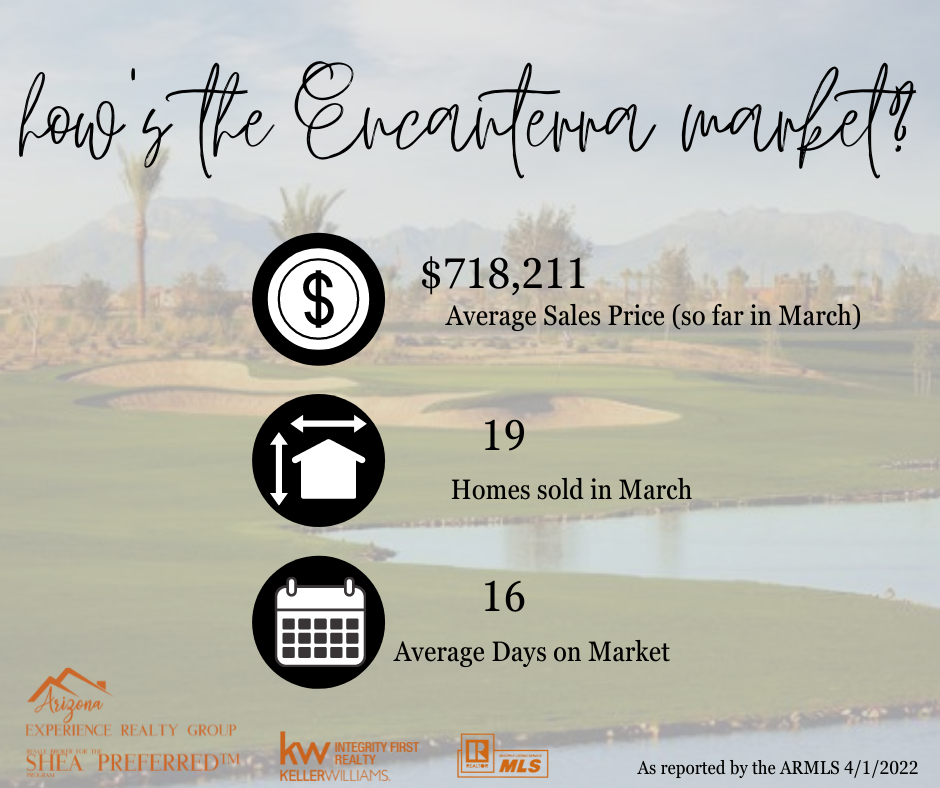

How’s the Encanterra Market for April 2022?

Encanterra Market Report March 2022

As reported by the ARMLS 4/1/2022

Current active listings: 9

Current under contract listings: 21

Current coming soon listings: 1

Still have questions? Or want to know your home’s value? Contact us today! We would be happy to discuss this or any other questions with you.