Mortgage Rates Hit Lowest Point So Far This Year

If you’ve been holding off on buying a home because of high mortgage rates, you might want to take another look at the market. That’s because mortgage rates have been trending down lately – and that gives you a chance to jump back in.

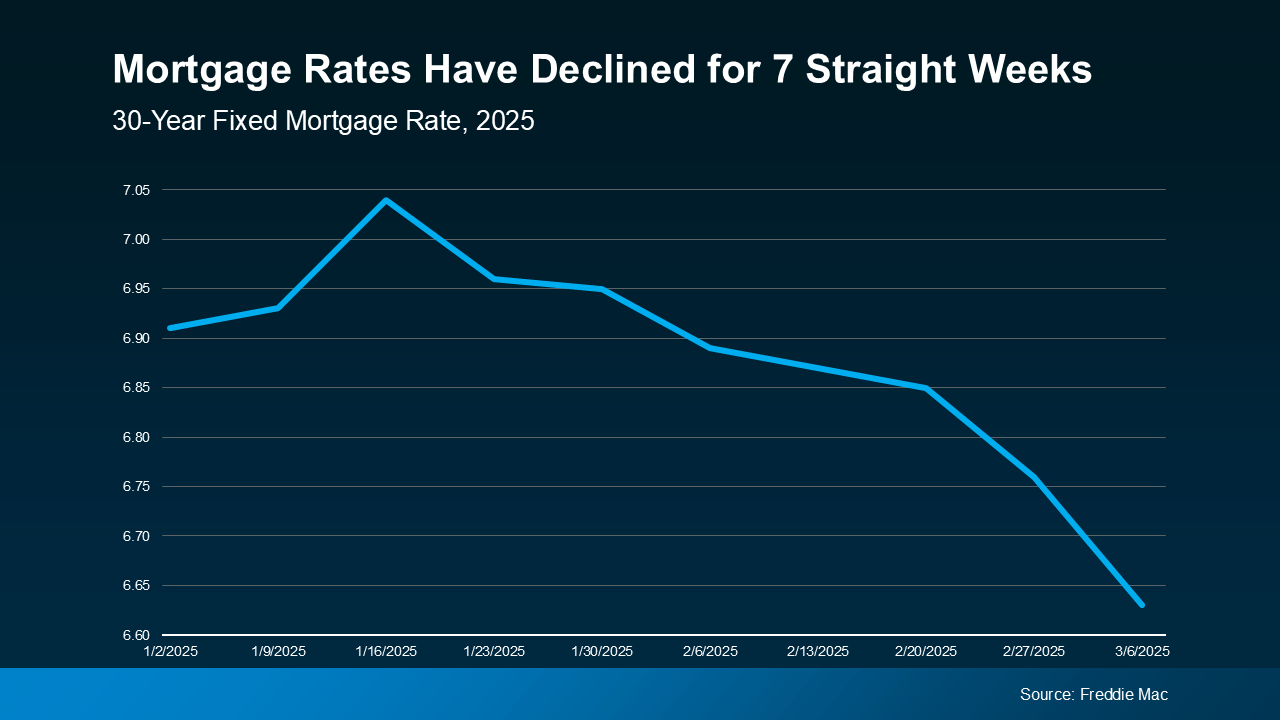

Mortgage rates have been declining for seven straight weeks now, according to data from Freddie Mac. And the average weekly rate is now at the lowest level so far this year (see graph below):

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

Why Are Rates Coming Down?

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), recent economic uncertainty is playing a role in pushing rates lower:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

And the timing of this recent decline is great because it gives you a little bit of relief going into the spring market. Just remember, mortgage rates can be a quickly moving target, so you should expect some volatility going forward. But the window you have as they’re coming down right now might be the sweet spot for your purchasing power now.

What Lower Rates Mean for Your Buying Power

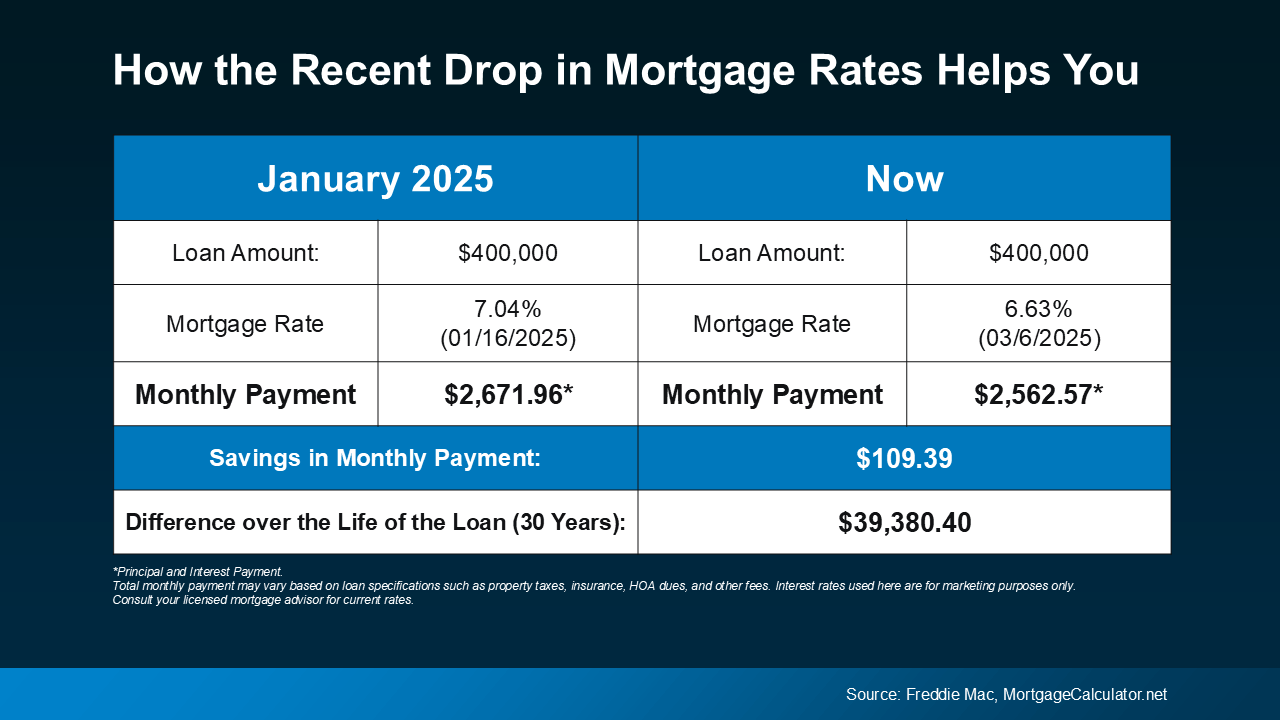

Even small changes in rates can make a difference to your monthly payment. Here’s how the math shakes out. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

Just remember, shifts in the economy drove rates down faster than expected. But that can change, making rates volatile in the days and months ahead. So, if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity if you’re ready to act.

Mortgage rates have dipped, giving buyers a bit more immediate breathing room. If you’ve been waiting for rates to ease before jumping in, this could be your window.

Would a lower monthly payment make buying a home feel more doable for you? Let’s break down the numbers and find out.

How To Buy a Home Without Waiting for Lower Rates

Many people are hoping mortgage rates will come down before they buy a home. But will that actually happen? According to the latest forecasts, experts say rates will decline, but not by as much as a lot of people want.

The good news? Even if they don’t drop substantially, there are still ways to make buying a home more affordable.

How Much Will Rates Drop?

A few months ago, experts were forecasting mortgage rates could dip below 6% by the end of the year. But recent projections suggest that may not happen after all.

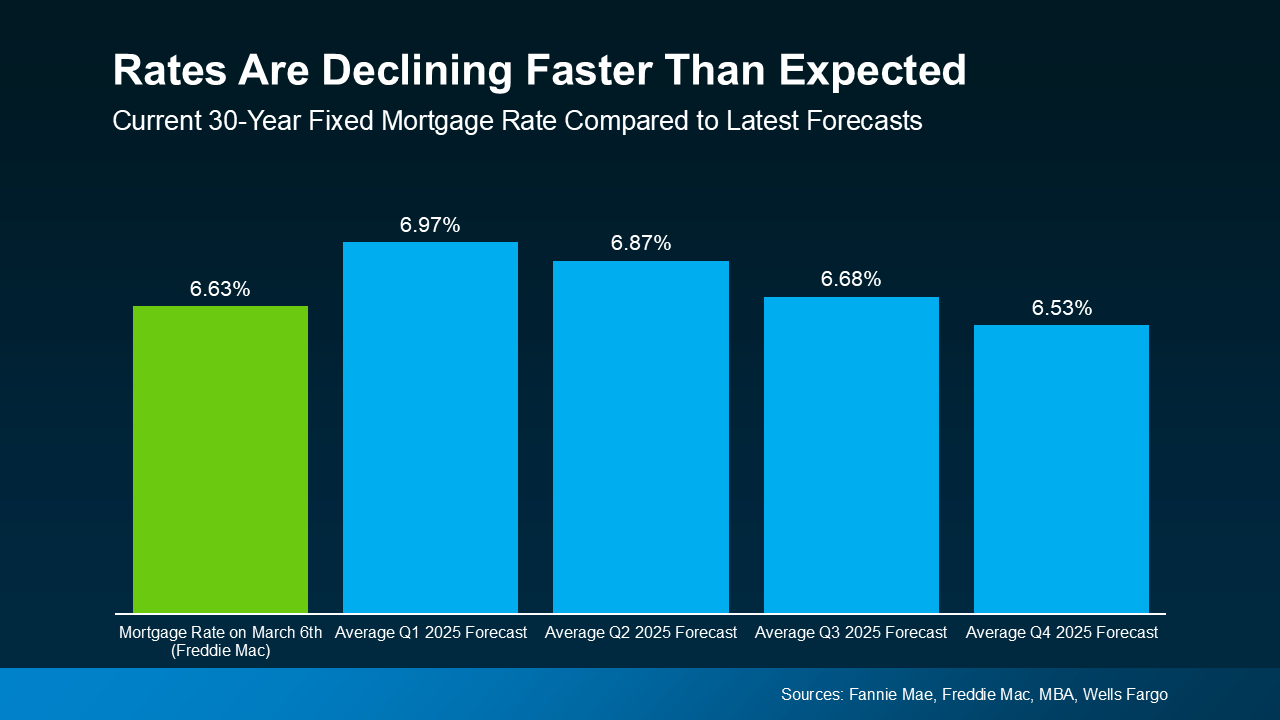

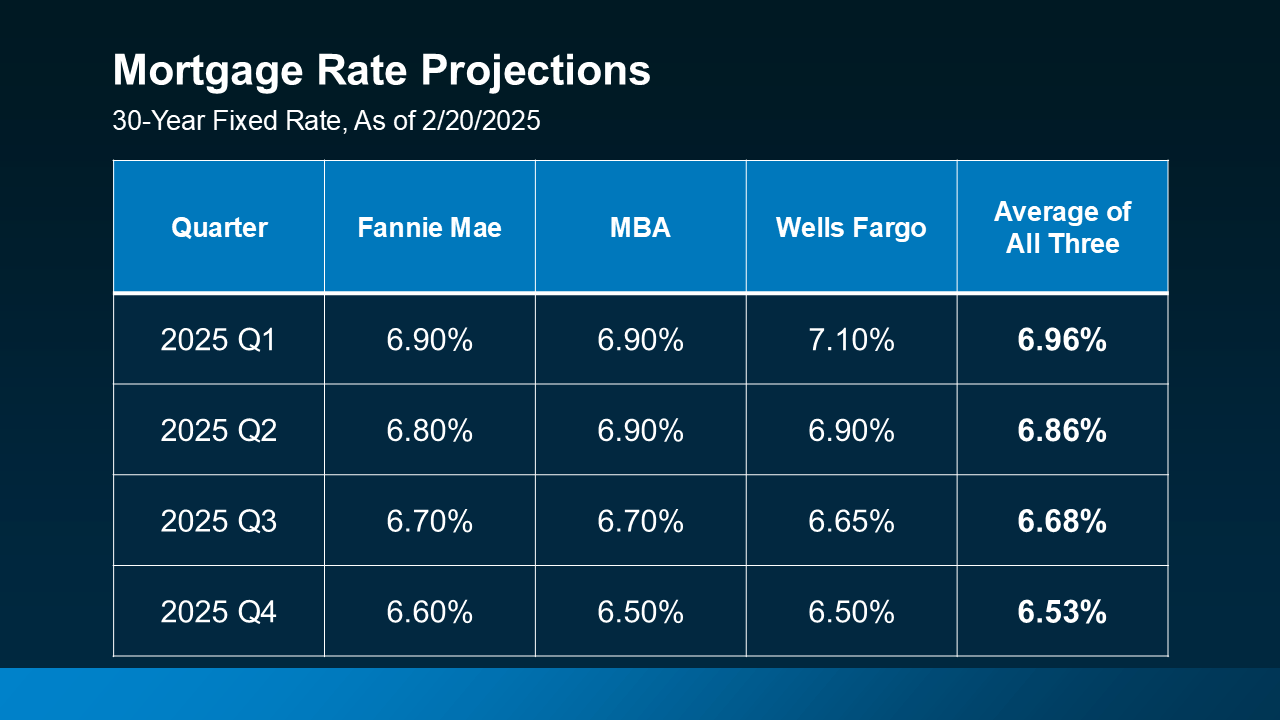

While mortgage rates are still expected to decline some later this year, projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now show them stabilizing closer to 6.5% by the end of the year (see below):

That means if you’re holding off on buying a home in hopes of much lower mortgage rates, you may be waiting a while. And if you need to move because something in your life has changed, like a new job, a new baby, or a marriage – waiting that long may not be an option.

Creative Financing Options in Today’s Market

Since rates aren’t expected to decline as much as originally expected, it may be worth considering alternative financing options that could help you get into a home sooner rather than later. Here are three strategies to discuss with your lender to see if any of these make sense for you:

1. Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee to lower your mortgage rate for a set period of time. This can be especially helpful if you want or need a lower monthly payment early on. In fact, 27% of agents say first-time homebuyers are increasingly requesting buydowns from sellers in order to buy a home right now.

2. Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) typically start with a lower mortgage rate than a traditional 30-year fixed mortgage. This makes them an attractive option, especially if you expect rates to drop in the coming years or plan to refinance later.

And if you remember the housing crash, know that today’s ARMs aren’t like the risky ones back then. Lance Lambert, Co-Founder of ResiClub, helps drive this point home by saying:

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

In simple terms, banks used to give loans without checking to see if buyers could afford them. Now, lenders verify income, assets, and jobs, reducing the risks associated with ARMs compared to the past.

3. Assumable Mortgages

An assumable mortgage allows you to take over the seller’s existing loan — including its lower mortgage rate. And with more than 11 million homes qualifying for this option according to U.S. News, it’s worth exploring if you want or need a better rate.

Bottom Line

Waiting for a big decline in mortgage rates may not be the best strategy. Instead, options like buydowns, ARMs, or assumable mortgages could make homeownership more affordable right now. Connect with a local lender to explore what works for you.

How does this impact your homebuying plans this year?

The 3 Biggest Mistakes Sellers Are Making Right Now

If you want to sell your house, having the right strategies and expectations is key. But some sellers haven’t adjusted to where the market is today. They’re not factoring in that there are more homes for sale or that buyers are being more selective with their budgets. And those sellers are making some costly mistakes.

Here’s a quick rundown of the 3 most common missteps sellers are making, and how partnering with an expert agent can help you avoid every single one of them.

1. Pricing the Home Too High

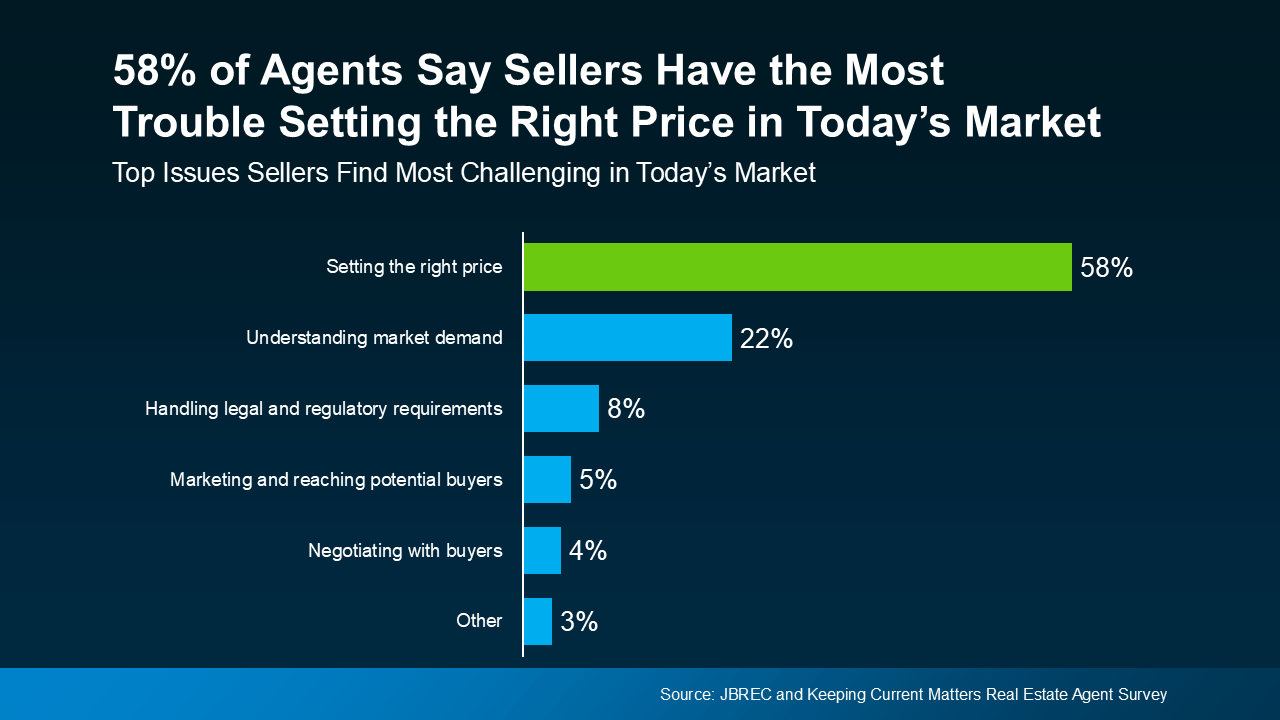

According to a survey by John Burns Real Estate Consulting (JBREC) and Keeping Current Matters (KCM), real estate agents agree the #1 thing sellers struggle with right now is setting the right price for their house (see graph below):

And more often than not, homeowners tend to overprice their listings. If you aren’t up to speed on what’s happening in your local market, you may give in to the temptation to price high so you can have as much wiggle room as possible to negotiate. You don’t want to do this.

And more often than not, homeowners tend to overprice their listings. If you aren’t up to speed on what’s happening in your local market, you may give in to the temptation to price high so you can have as much wiggle room as possible to negotiate. You don’t want to do this.

Today’s buyers are more cautious due to higher rates and tight budgets, and a price that feels out of reach will scare them off. And if no one’s looking at your house, how’s it going to sell? This is exactly why more sellers are having to do price cuts.

To avoid this headache, trust your agent’s expertise from day 1. A great agent will be able to tell you what your neighbor’s house just sold for and how that impacts the value of your home.

2. Skipping Repairs

Another common mistake is trying to avoid doing work on your house. That leaky faucet or squeaky door might not bother you, but to buyers, small maintenance issues can be red flags. They may assume those little flaws are signs of bigger problems — and it could cost you when offers come in lower or buyers ask for concessions. As Investopedia says:

“Sellers who do not clean and stage their homes throw money down the drain. . . Failing to do these things can reduce your sales price and may also prevent you from getting a sale at all. If you haven’t attended to minor issues, such as a broken doorknob or dripping faucet, a potential buyer may wonder whether the house has larger, costlier issues that haven’t been addressed either.”

The solution? Work with your agent to prioritize anything you’ll need to tackle before the photographer comes in. These minor upgrades can pay off big when it’s time to sell.

3. Refusing To Negotiate

Buyers today are feeling the pinch of high home prices and mortgage rates. With affordability that tight, they may come in with an offer that’s lower than you want to see. Don’t take it personally. Instead, focus on the end goal: selling your house. Your agent can help you negotiate confidently without letting emotions cloud your judgment.

At the same time, with more homes on the market, buyers have options — and with that comes more negotiating power. They may ask for repairs, closing cost assistance, or other concessions. Be prepared to have these conversations. Again, lean on your agent to guide you. Sometimes a small compromise can seal the deal without derailing your bottom line. As U.S. News Real Estate explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . the only way to come to a successful deal is to make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

The Biggest Mistake of All? Not Using a Real Estate Agent

Notice anything? For each of these mistakes, partnering with an agent helps prevent them from happening in the first place. That makes trying to sell your house without an agent’s help the biggest mistake of all.

Bottom Line

Avoid these common mistakes by starting with the right plan — and the right agent. Let’s connect at SHEA PREFERRED REALTY

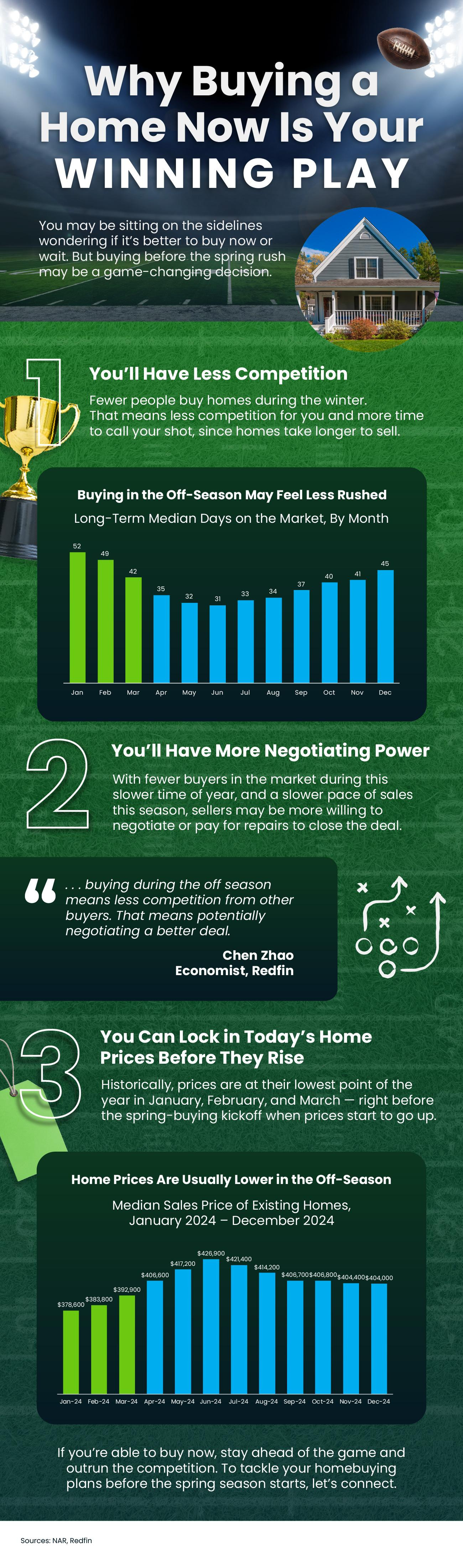

Why Buying a Home Now Is Your Winning Play

2025 Housing Market Forecasts

The Truth About Lowball Offers: Why Strategy Matters in Real Estate

In today’s real estate market, one trend has been making waves: buyers tossing out lowball offers hoping to snag a deal. While it might sound like a clever tactic, the reality is that lowball offers rarely work—and they often do more harm than good for both buyers and sellers.

Let’s break down what happens when these offers hit the table and how a strategic approach can lead to better outcomes for everyone involved.

Why Lowball Offers Don’t Work

Lowball offers can feel like a slap in the face to sellers who have invested time and money in their property. These offers often lead to two scenarios:

- Immediate Rejection: Sellers might outright dismiss an offer that feels insulting, leaving no room for negotiation.

- Counter Offers and Frustration: Sometimes, lowball offers spark counter-offer situations that rarely lead to agreements where both parties feel satisfied.

As a result, lowball offers typically fail to achieve the buyer’s goal of “getting a deal.” Instead, they often create tension, delay the process, and leave everyone feeling frustrated.

The Better Approach: It’s Not Where You Start—It’s Where You End

As your real estate agent, I always emphasize that it’s not where you start in negotiations, but where you end. Successful real estate transactions come down to strategic planning, patience, and understanding the market.

Here’s how I guide my clients:

- Positioning Your Property Right:

For sellers, pricing your home competitively and showcasing its value is the key to attracting serious buyers. When your home is positioned as a valuable, must-see property, it draws offers that are worth your time and consideration. - Focusing on Realistic Offers:

For buyers, understanding market trends and what sellers value is crucial. A realistic offer—one that reflects the true worth of a property—shows seriousness and opens the door to productive negotiations. - Navigating Offers Strategically:

Whether you’re a buyer or a seller, I’ll help you navigate offers with a level head and a clear strategy. By taking emotion out of the equation and focusing on the big picture, we can move toward an agreement that benefits everyone.

Patience and Trust Lead to Success

At the end of the day, real estate isn’t about shortcuts or tricks—it’s about trust, patience, and a solid plan. As your agent, I’m here to make sure your property is positioned to attract the right buyers and that every offer we consider is worth your time.

Have Questions? Let’s Talk!

Whether you’re buying or selling, navigating offers doesn’t have to be stressful. Let’s work together to create a strategy that ensures you get the best possible outcome.

Contact me today to discuss how we can make your real estate journey smooth, successful, and rewarding.

Get Ready to Buy a Home in 2025

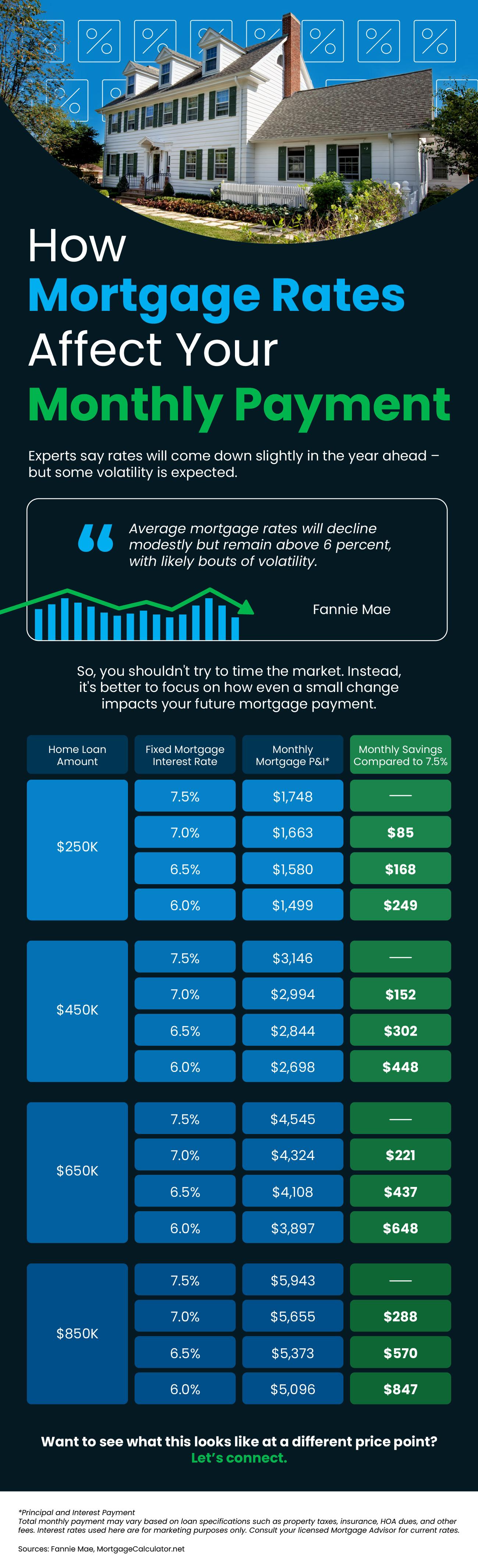

How Mortgage Rates Affect Your Monthly Payment

Experts forecast mortgage rates will come down in 2025, but they also say you should brace for some volatility. That’s why it’s not a good idea to try to time the market. Instead, it’s better to focus on how even a small change impacts your bottom line. Even a slight decline in rates can help lower your future monthly payment. Want to see what this looks like at a different price point? DM us!

New Year, New Home: How To Make It Happen in 2025

This is the time when a lot of people take a moment to reflect and set their goals for this year. And as you picture what you want your 2025 to look like, one thing that may pop into your mind is the vision of you in a new home. But how do you get there? And where do you start?

Here’s some advice that can help you get the ball rolling.

Focus on Your Why

To lay the foundation, you need to focus on your why. While the dollars and cents are important, so is the driving force behind your desire to move. Maybe you need more space for a growing family, want to sell so you can downsize, or are finally ready to buy your first home. Whatever your reason, it’s important to keep it front and center.

Your why is what helps you stay focused. Share your motivation with your agent and they’ll use their expertise to help support that goal, no matter what the market looks like. With a great agent by your side, you’ll have someone to guide you, problem-solve, and keep you moving forward until you can check that goal off your to-do list.

Get Clear on What You Need

Then it’s time to figure out what your next home needs to have. How many bedrooms do you need? If you don’t have a designated home office, is that a deal-breaker? What about a big fenced-in backyard? Knowing your must-haves and nice-to-haves makes the search a lot smoother.

Since affordability is still tight, it’s important to have a clear idea of your essential items upfront. Maybe you can flex a bit on location, if it’s got everything else you’re looking for. Go over those essential items with your agent and they’ll help you focus on the homes that check the boxes that matter most while staying within your price range.

Know Your Numbers

Before you jump in, take a look at your finances. How much have you saved? What monthly payment feels comfortable? Getting clear on your budget early will help you know what’s possible.

The best way to do this is by partnering with trusted real estate professionals, like a local agent and a lender. They’ll help you:

- Plan for your down payment and look into down payment assistance programs

- Understand the equity you have in your current home and how you can use it to fuel your next move if you’re selling

- Get pre-approved for a mortgage so you know what you can borrow

Lean on a Pro To Guide You

It can be hard to know where to start, but you don’t have to do it alone. A real estate agent knows what you need to do to get ready to buy or sell, how to navigate the process, and can answer your questions every step of the way. As Bankrate puts it:

“. . . now more than ever, it’s smart to lean on the guidance of an experienced local real estate agent. If you want to enter the housing market in 2025, whether as a buyer or a seller, let a pro lead the way for you.”

Remember, buying or selling is a big milestone and a great goal for this year. With the right expert on your team, you’ll feel confident and ready to take on the market.

If buying or selling a home is part of your goals for 2025, now’s the time to get started. Focus on your why, know what you need, and connect with trusted pros to make it happen. Let’s team up and make this the year you accomplish your real estate resolutions. Contact us at SHEA PREFERRED REALTY GROUP